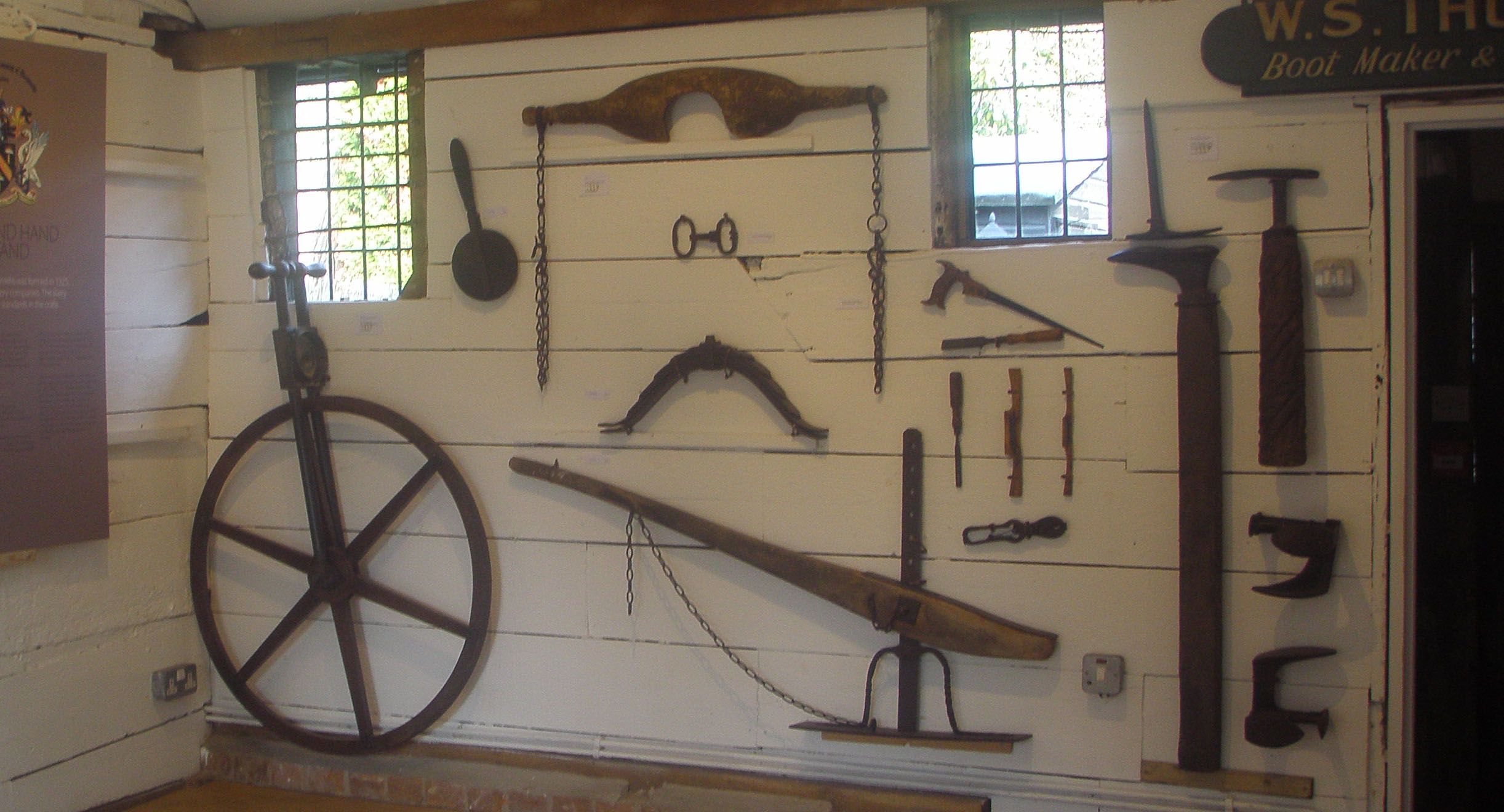

A display at the Much Hadham Forge Museum

Subscribe

Subscription

to the Trust annual fees

Individual

£20

Joint

£30

Society

£30

Corporate

£75

Subscription

to the Trust lifetime fees

Individual

£200

Joint

£300

Society

£300

Corporate

£750

Methods of

payment

BACS

please use:

Sort: 40

51 62

Account

number: 37135018

Account

name: Hertfordshire Building Preservation Trust

Reference:

Surname

Cheques -

please make out to Hertfordshire Building Preservation Trust and

send to:

HBPT

The

Castle

Hertford

SG14

1HR

Standing

order:

Please

contact the office for a form

In all

cases please let us have:

Full Name

(s) including title

Address:

Post

Code:

Email:

Signature:

And let us

know if we can claim the Gift Aid

back.

The Mill Guides Annual Outing

Volunteer

Mill Guide, Cromer Windmill

If you can spare just two or three afternoons during the summer,

help bring the mill to life for its visitors by becoming a Mill

Guide. You will be given all the information needed in order to

know more than 99% of our visitors, (and you will be able to learn

from the other 1% anyway!)

Contact:

enquiries@cromerwindmill.co.uk

Much Hadham Forge Museum

The MHFM is looking for volunteers to assist the Curator with a

variety of jobs at this small but dynamic museum. The number of

hours will be by arrangement with the Curator.

Contact:

Croxley Great Barn, Rickmansworth - grade II* listed 14th century aisled barn

A Gift in Your Will

As a registered charity, the Hertfordshire Building Preservation Trust relies now, more than ever on the support of individuals. One of the ways that you can help to ensure that the Trust continues its work for future generations is by supporting it with a gift in your will. Anyone can include a gift in their will, however large or small, all legacies are gratefully received and will be put to good use.

There are four ways that you can support the Trust through a gift in your will these are:

A Residual Legacy

This is a donation

of the remainder or a percentage of your estate after all debts,

taxes, expenses and other bequests have been made.

Pecuniary Legacy

This is

simply a fixed sum donation decided by you.

Specific Legacy

You may like to leave the Trust a personal possession or

asset including property, stocks and shares

etc

Revisionary Legacy

This is a valuable way of providing for your loved ones first. It

involves leaving assets to a specified beneficiary to enjoy during

their lifetime, with the whole or a portion reverting the Trust, on

their death.

A

gift in your will to the Trust can prove extremely tax-efficient.

The Trust has full charitable status; gifts made in this special

way are not subject to inheritance

tax.

Your will is one of the most important documents you will ever make so the Trust recommends that you seek the advice of a solicitor.